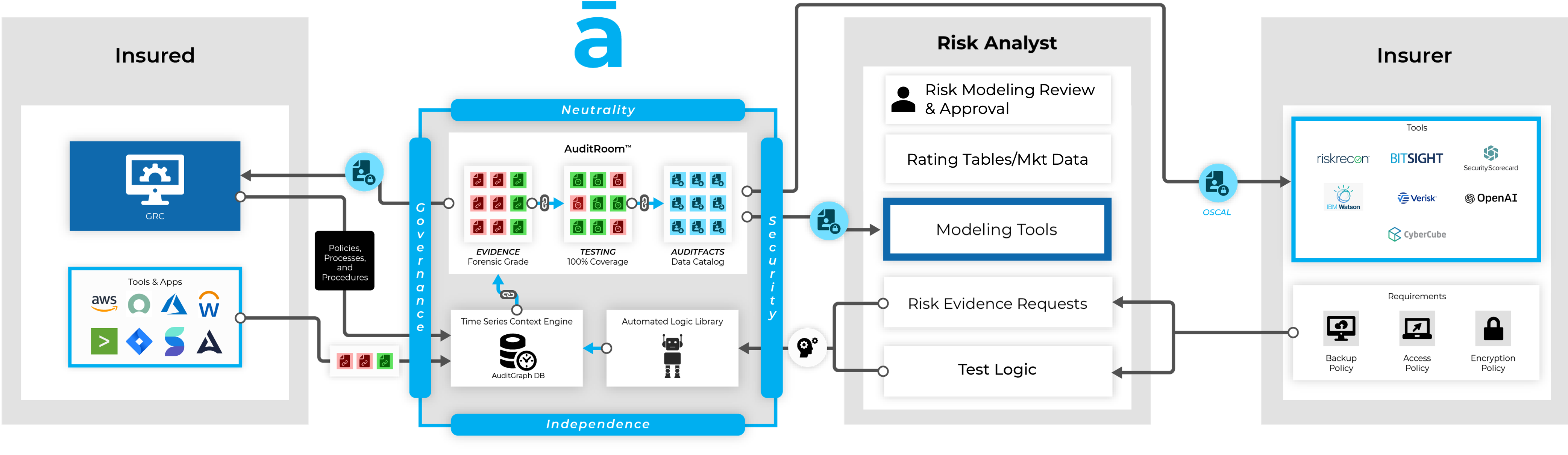

Auditmation enables cyber insurers to extend outside in risk assessments and scanning with mechanized audits of the insured's actual risk data through a centralized cyber risk logic library.

Auditmation is the neutral arbiter machine that is not incentivized by any preferred outcomes. Instead, it drives to the truth and nothing but the truth. It empowers cyber insurers with direct to source access to inform better decisions based on real time, stack ranked risk data with a forensic chain of custody.

Compliment external scanning data with direct to source access to insured’s data

Machine collected evidence with no human handling or tampering

Every piece of evidence has complete forensic chain of custody

Centralize mechanized cyber knowledge to ensure scale, integrity, and visibility

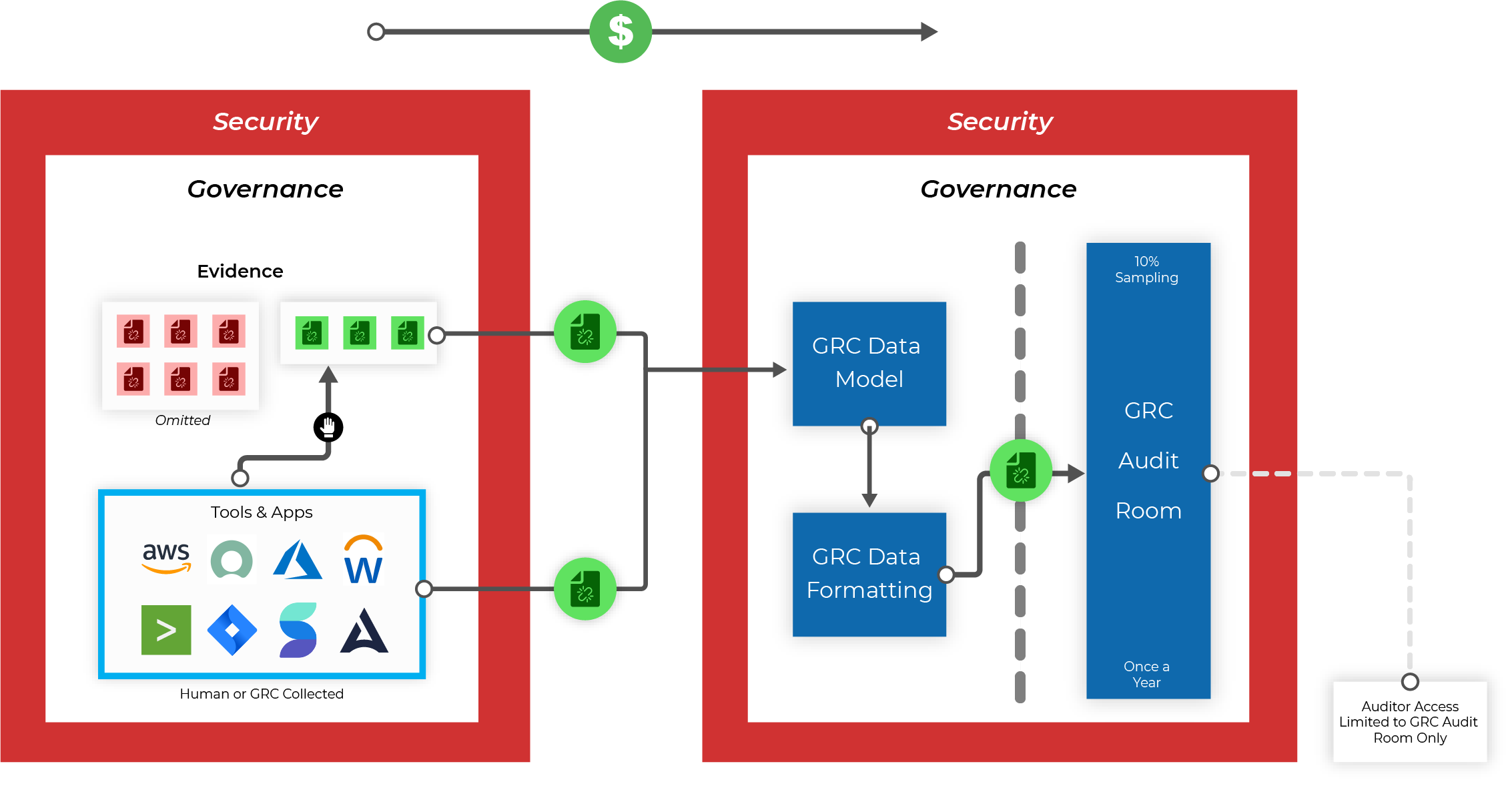

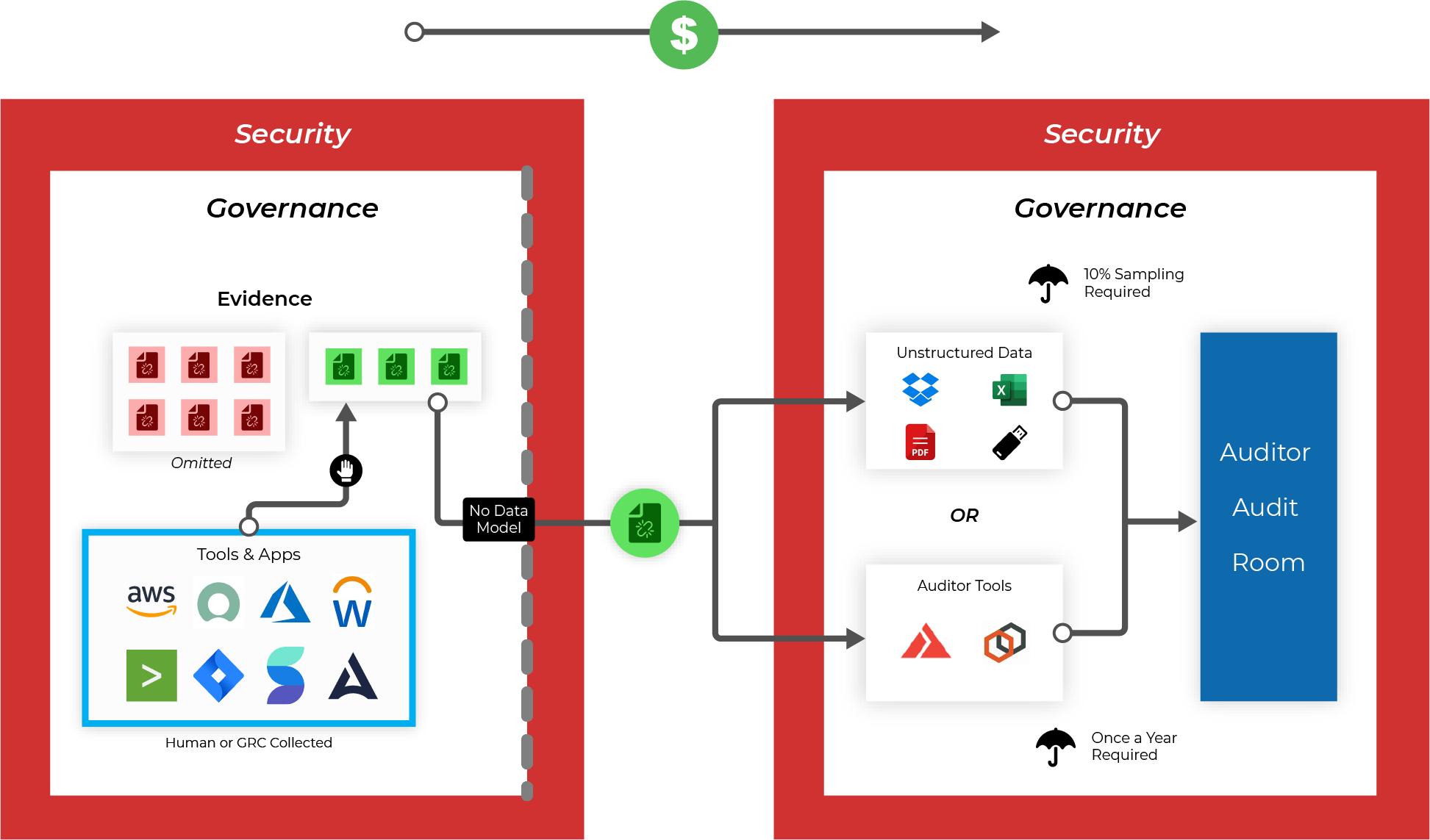

Operational GRC tools like Drata, Tugboat, and Anecdotes try to force auditors to learn the nuances of each of their systems across a multitude of audits.

Auditors force auditees to manufacture and ship data to hundreds of audit rooms. No centralized platform to stitch models and tools to unlock all parties in the ecosystem.

Auditee pays Auditor, and GRC tools that collect evidence on their behalf

10% population sampling omits 90% of all relevant evidence

Human-based audit processes drive bias, risk, and do not scale

Human and GRC collected evidence has no forensic chain of custody

Annual audits bring little to zero value to cyber readiness

Gated access hides the truth, dependent on Auditee evidence and quality

Headquartered in Austin, TX, Auditmation is the 3rd party IT audit and risk automation data platform enabling auditors, advisory and risk tools to strengthen audit integrity and independence in a neutral, mechanized data room.Automated evidence and testing creates higher value, tech-enabled audit and risk assurance services for our partners, that reduces the audit burden and drives cyber risk out of their client organizations and vendors, through ZeroBias™ audit data quality.

The Auditmation™ platform is available exclusively through our audit, advisory, and technology partner network.

View our Privacy Policy or Transparency of Coverage

(888) 988-8647

sales@auditmation.io

zerotrust@auditmation.io (Working group)

Auditmation

12400 Highway 71 West

Suite 350-407

Austin, TX 78738

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |